In today’s digital-first environment, Know Your Customer (KYC) verification is pivotal not just for compliance but as a cornerstone of secure and trustworthy customer relationships. Amidst tightening global regulations, businesses are challenged to streamline their KYC processes without sacrificing user experience. StackGo’s IdentityCheck emerges as a beacon of innovation, offering seamless integration into existing tech stacks to automate and enhance KYC verification.

The Importance of KYC in Today’s Digital World

Navigating Regulatory Landscapes

Global financial regulations are more stringent than ever, with anti-money laundering (AML) and KYC norms at the forefront of the fight against financial crimes. Compliance isn’t just a legal requirement; it’s a critical aspect of operational integrity and market reputation.

Enhancing Customer Trust and Security

Effective KYC processes are instrumental in mitigating fraud, ensuring only legitimate customers are onboarded. This not only secures the platform from potential financial crimes but also builds a foundation of trust with customers, knowing their transactions are safe and secure.

The Challenges of Traditional KYC Verification

Time-Consuming Processes

Traditional KYC methods are notorious for their lengthy onboarding times, often marred by manual document reviews and verifications that lead to a frustrating customer experience.

High Costs and Error Rates

Manual KYC processes are not only costly, requiring significant human resources, but are also prone to errors. These inaccuracies can lead to compliance risks and operational inefficiencies.

The Rise of Automated KYC Verification

Leveraging Technology for Efficiency

Automated KYC solutions harness AI, machine learning, and advanced document verification technologies to streamline the verification process. This automation significantly reduces onboarding times while enhancing accuracy.

The Role of APIs in KYC Automation

APIs revolutionize KYC processes by facilitating seamless integration of verification services into existing systems. This connectivity allows for real-time data exchange and process automation, making KYC checks more efficient and less intrusive.

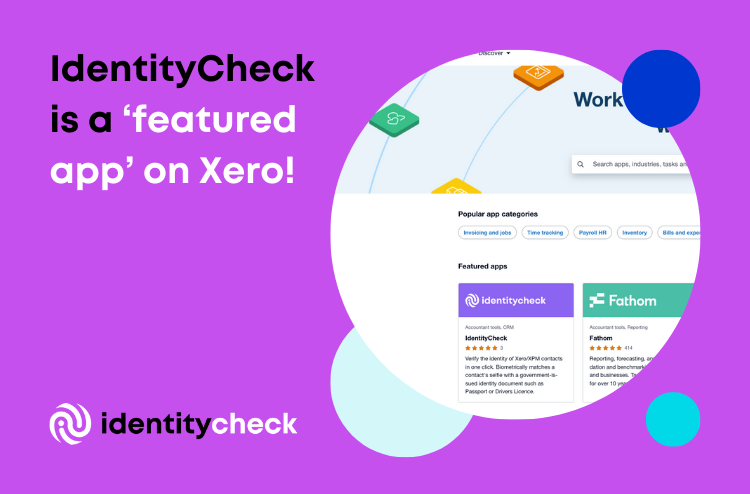

StackGo’s IdentityCheck: A Cut Above the Rest

Seamless Integration with Your Tech Stack

IdentityCheck is designed to blend into your existing infrastructure, automating KYC checks without the need for extensive system modifications. This integration capability ensures that businesses can enhance their KYC processes without disrupting their current operations.

The Benefits of StackGo’s Approach

- Reduced Onboarding Times: Automating verification processes slashes customer onboarding times, enhancing the user experience.

- Enhanced Accuracy and Compliance: With automated checks, IdentityCheck minimizes human error, ensuring higher accuracy and easier regulatory compliance.

- Cost Savings: By automating routine verifications, businesses can allocate resources more efficiently, leading to significant cost reductions.

How StackGo’s IdentityCheck Works

IdentityCheck simplifies the KYC process: once integrated into your system, it automatically verifies customer identities against official documents like driver’s licenses or passports. This process is not only quick but also secure, ensuring compliance and reducing manual workload.

Future Trends in KYC Verification

The Shift Towards Digital Identity Verification

The future of KYC lies in digital identity solutions, where physical documents are replaced by digital IDs. This shift promises to make verifications even faster and more secure, with technologies like blockchain playing a pivotal role.

The Growing Importance of Data Privacy

As digital verification becomes the norm, balancing thorough checks with data privacy will become increasingly crucial. Future KYC solutions will need to ensure robust verification while adhering to strict data protection standards.

Why Choose StackGo’s IdentityCheck for Your KYC Needs

StackGo’s IdentityCheck stands out as the premier solution for businesses seeking efficient, integrated KYC verification. Its unique ability to seamlessly mesh with existing tech stacks, coupled with its automation capabilities, prepares businesses for the future of digital identity verification, making KYC processes more efficient and user-friendly.

Discover how StackGo’s IdentityCheck can revolutionize your KYC verification process. Get in touch today to explore a seamless, secure, and compliant future for your customer onboarding.