Fraud-fighting tech stack with Veriff Voices

Building Trust in Identity Verification with Matt Collis, CEO of StackGo In a recent episode of the Veriff Voices podcast, Chris Hooper from Veriff spoke

IdentityCheck is ideal for regulated businesses worldwide and those at risk of fraud. It caters to various industries such as Accounting, Legal, Payments, Real Estate, Sustainability, Leasing, Financial Advice, and Education.

Learn more about how Accountants and Tax Agents use our XPM Solution below

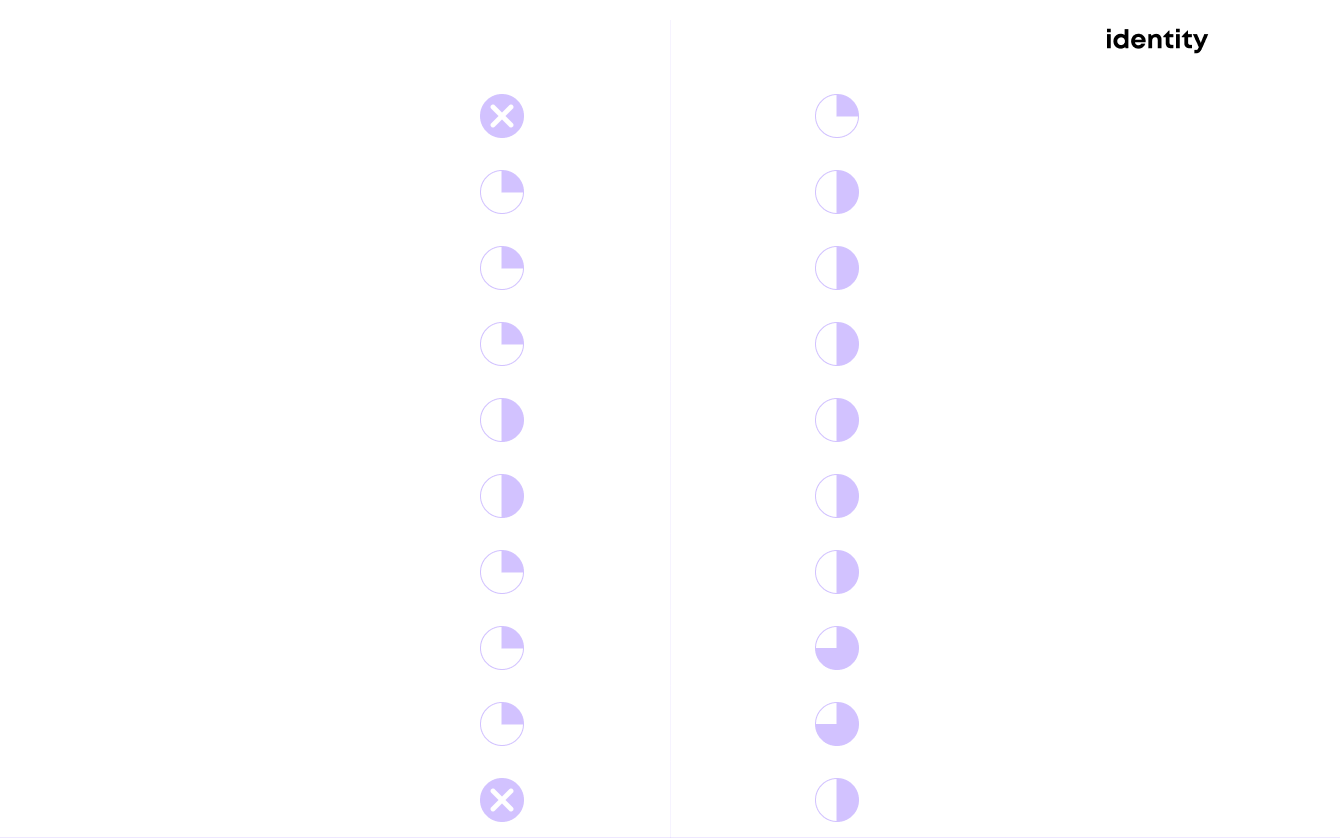

Automated identity checks are 500x more effective than manual processes, offering a robust and scalable solution while eliminating the expenses and unreliability associated with manual methods.

Expensive & Unreliable

Robust & Scalable

Cost of the process

Time required to process

Security and Privacy risk

Customer & Staff experience

How prone to errors

Cost of the process

Time required to process

Security and Privacy risk

Customer & Staff experience

How prone to errors

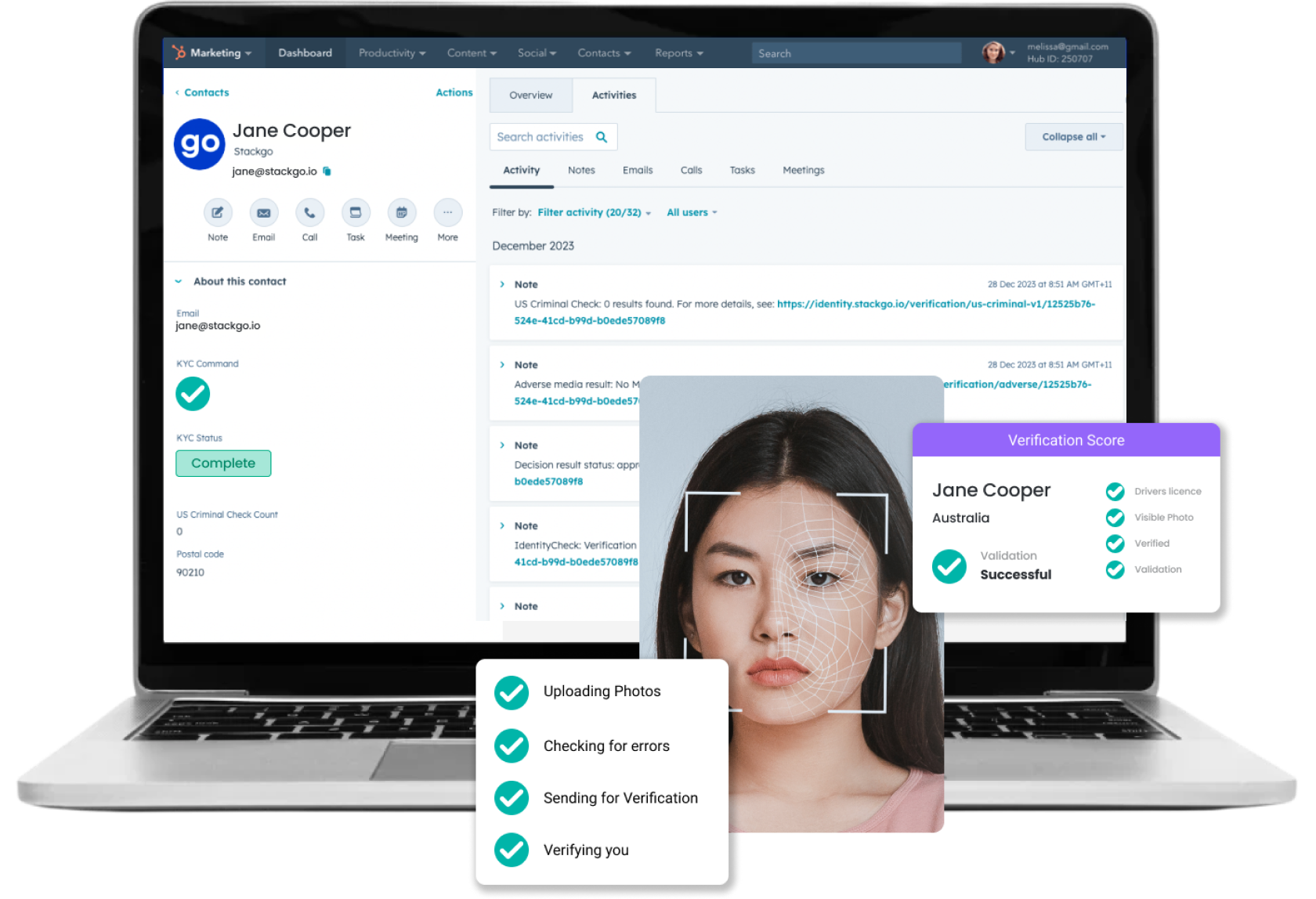

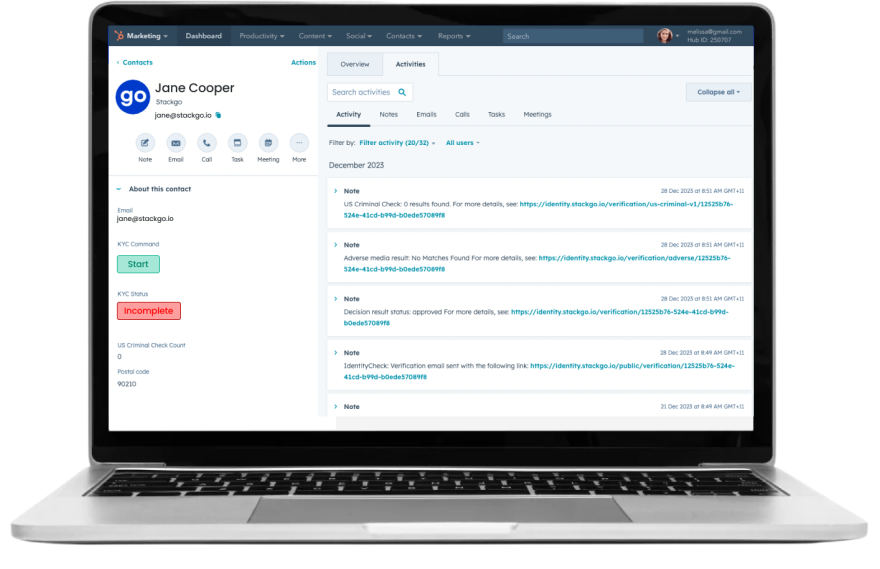

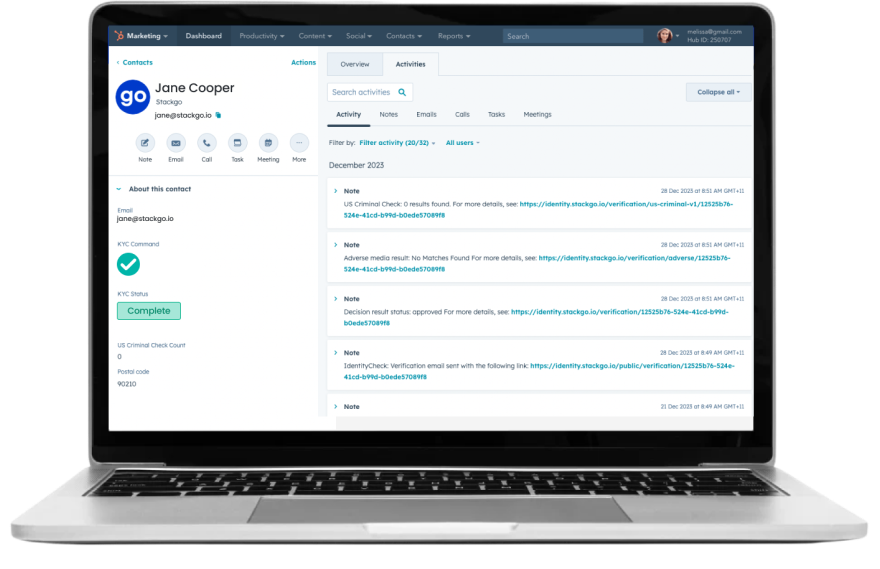

IdentityCheck provides seamless KYC right inside your existing software

Streamline the process and remove manual steps by integrating with your existing software. Sign up to view the full list.

All plans include the first 3 checks free, no credit card required.

Why IdentityCheck is the perfect choice for your automated ID verification requirements

Optional extras to help you get started.

KYC means Know Your Customer. A KYC Check is a process for validating the identity of an individual using government-issued identity documents. KYC is mandatory in many environments, including banks or other organisations prone to fraud. KYC is typically required in new account opening, or at other key stages of transactions.

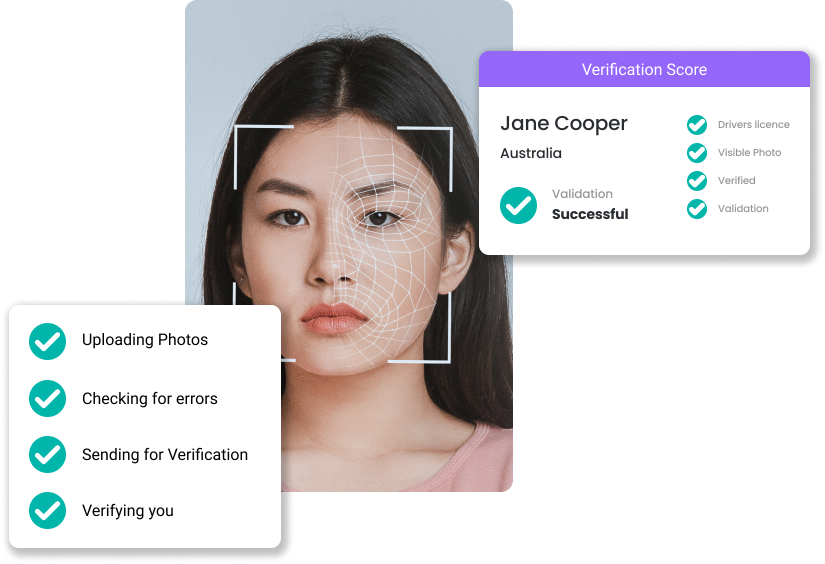

You can request KYC for any contact from within your CRM (E.g. HubSpot). IdentityCheck emails the contact a unique URL, which they click on to commence the KYC process. The contact is prompted to correctly take a picture of their government-issued documents, and a selfie. The images are used by our platform to determine if the identity is valid. The result (positive or negative), plus a link to the raw images are added to the contact record inside your CRM.

IdentityCheck accepts over 10,000 document types from over 200 countries to verify the identity of an individual. This includes passport, drivers licence, ID card, and residency permits.

Once the KYC documents are submitted, over 1,000 data points are analysed through a device and network fingerprinting solution. The average decision time is made in just 6 seconds, and 95% are complete on the first try!

IdentityCheck is powered by a KYC platform that is compliant with GDPR, WCAG, CCPA, and SOC 2 Type II

KYC verification is completed by leveraging more than 1,000 data points including device, network, document, video, biometric, and behavioural information. The platform that powers KYC checks uses biometric authentication to confirm a user is who they claim to be, and mitigates fraudulent activities including account takeover and identity theft.

Yes, absolutely! After an individual’s identity has been verified, we extract the full legal name and DOB from the ID document. We automatically screen those details for PEP/Sanctions, and Adverse Media, as required. If there are potential matches, we will notify you via the CRM, with a link to the details. There is an additional cost per check, starting at US$0.75.

Building Trust in Identity Verification with Matt Collis, CEO of StackGo In a recent episode of the Veriff Voices podcast, Chris Hooper from Veriff spoke

On July 24th, 2024, StackGo had the pleasure of participating in a speed dating webinar alongside our implementation partner, Clarity Street. This event was a

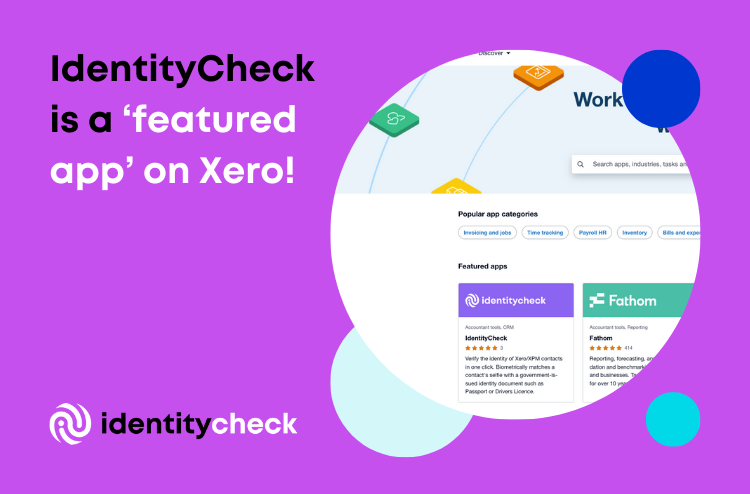

We are thrilled to announce that IdentityCheck is now a featured app on the Xero App Store, under the Featured Apps collection! This recognition is